betrase.site

Recently Added

Does A Pre Approval Mean A Mortgage

What does pre-qualified mean? Pre-qualification is an informal way for a lender to review your financial information and estimate how much you may be able to. Preapproval Letter. The preapproval letter we'll give you includes an estimate of how much you could borrow based on what you tell us about your income, assets. Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets, confirmation of income, good credit, employment. Mortgage pre-approval: Making it official. When you get pre-approved, on the other hand, the lender is giving you approval for a specific loan amount under. It is important to note that a pre-approval Is not a guarantee that your mortgage will be approved. A pre-approval is a good indication that the lender will. Mortgage Pre-approval should be your first step when looking for a home to buy Waiting to apply for a mortgage may mean you're stuck with higher rates. A pre-approved mortgage means a lender has reviewed your financial history and determined you may qualify for a loan up to a certain amount. A pre-approval letter is a document from a lender that is based on the financial information you gave them. This letter does not make a promise. What Does Pre-approval Mean? Pre-approval is a full underwriting package, meaning, you know before you even find your house that you're approved to buy at a. What does pre-qualified mean? Pre-qualification is an informal way for a lender to review your financial information and estimate how much you may be able to. Preapproval Letter. The preapproval letter we'll give you includes an estimate of how much you could borrow based on what you tell us about your income, assets. Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets, confirmation of income, good credit, employment. Mortgage pre-approval: Making it official. When you get pre-approved, on the other hand, the lender is giving you approval for a specific loan amount under. It is important to note that a pre-approval Is not a guarantee that your mortgage will be approved. A pre-approval is a good indication that the lender will. Mortgage Pre-approval should be your first step when looking for a home to buy Waiting to apply for a mortgage may mean you're stuck with higher rates. A pre-approved mortgage means a lender has reviewed your financial history and determined you may qualify for a loan up to a certain amount. A pre-approval letter is a document from a lender that is based on the financial information you gave them. This letter does not make a promise. What Does Pre-approval Mean? Pre-approval is a full underwriting package, meaning, you know before you even find your house that you're approved to buy at a.

A pre-approved mortgage is a tentative promise from a lender that it will loan you a certain amount of money for the purchase of real estate. What does getting pre-approved for a mortgage mean? When you get pre-approved, you find out how much you can borrow and spend when buying a home. This amount. A mortgage pre-approval is essentially a stamp of approval from a lender. It's very similar to the process of applying for a mortgage loan. A preapproval shows how much you're eligible to borrow. · Personal Information: name, address, social security number, and birthdate · Loan Amount · Down Payment. Pre-approval means someone has looked over the transaction and has provided a pre-approval of the mortgage. If you receive pre-approval. However, loan officers do not make the final approval, so a pre-qualification is not a commitment to lend. After the loan officer determines that you pre-. Pre-approval, on the other hand, means the lender has already done its due diligence and is willing to loan you the money. Plus, you've got an official letter. Determining whether you should get a mortgage prequalification vs preapproval letter can happen before you even find a house to buy! Both letters show that you'. Mortgage pre-approval is a little different. A lender does a more thorough review of your financial situation, including a credit check. If you're pre-approved. What does getting pre-approved for a mortgage mean? It means a lender has confirmed your eligibility for a loan up to a certain amount based on an initial. A pre-approval is a non-binding statement saying, based on a cursory review of your unverified financial status, that you are eligible for a loan up to a. Just like pre-qualification, a pre-approval does not guarantee a loan, but it provides a more precise estimate of how much your financial institution is willing. Mortgage preapproval is the process of determining how much money you can borrow to buy a home. To preapprove you, lenders look at your income. Keep in mind that just because you have your mortgage preapproval completed it does not mean that you are guaranteed a mortgage for every property you write an. It's important to understand that pre-qualification and pre-approval are not the same and knowing which option you should go with can make a big difference. A mortgage pre-approval is evidence that you can qualify for a loan to purchase a home. Learn how pre-approval is calculated and more. To get a PriorityBuyer® Preapproval Letter, you'll submit a mortgage application and the bank will do a limited credit review. If you're approved, the agent and. What does a mortgage preapproval letter mean? If you're following the traditional steps to buying a home, you may have been pre-qualified by a lender early on. In lending, a pre-approval is the pre-qualification for a loan or mortgage of a certain value range. For a general loan a lender, via public or proprietary. What Does It Mean to Get Pre-approved for a Mortgage? Getting pre-approved means a lender has taken a close look at your current financial health, and is.

Top Checking Banks

Bank of America Advantage Banking. Get the flexibility you deserve. Choose a checking account to meet you where you are in your journey. With the Top Tier Checking Account, you earn a competitive interest rate on all balances and an even higher interest rate with a daily balance of $1, or more. Find a great checking account and research rates, fees and account features at US News & World Report. Discover the different types of checking accounts available, learn how to manage and utilize your account effectively and read a guide on opening a checking. Compare Checking & Savings Accounts ; Checking. A fee-free online account for everyday use, including a top-rated mobile app. ; Performance Savings. Checking wherever (and however) you want · Low (or no) costs: No ATM fees and/or low (or no) monthly maintenance fees · Convenience: Nearby branch & ATM access. Our ranking of the best high-interest checking accounts that are available nationwide all pay at least %, with the top-paying account reaching as high as a. 's Best Checking Accounts - Editors' Picks ; Best: Checking Account, Best Feature ; Overall, Primis Premium Checking, Up to % APY ; Highest APY, Redneck. US News carefully evaluated over 80 banks and credit unions. Find the right bank for your needs, from large national institutions to online-only savings banks. Bank of America Advantage Banking. Get the flexibility you deserve. Choose a checking account to meet you where you are in your journey. With the Top Tier Checking Account, you earn a competitive interest rate on all balances and an even higher interest rate with a daily balance of $1, or more. Find a great checking account and research rates, fees and account features at US News & World Report. Discover the different types of checking accounts available, learn how to manage and utilize your account effectively and read a guide on opening a checking. Compare Checking & Savings Accounts ; Checking. A fee-free online account for everyday use, including a top-rated mobile app. ; Performance Savings. Checking wherever (and however) you want · Low (or no) costs: No ATM fees and/or low (or no) monthly maintenance fees · Convenience: Nearby branch & ATM access. Our ranking of the best high-interest checking accounts that are available nationwide all pay at least %, with the top-paying account reaching as high as a. 's Best Checking Accounts - Editors' Picks ; Best: Checking Account, Best Feature ; Overall, Primis Premium Checking, Up to % APY ; Highest APY, Redneck. US News carefully evaluated over 80 banks and credit unions. Find the right bank for your needs, from large national institutions to online-only savings banks.

See the best checking accounts to serve as your financial hub based on monthly fees, interest rates, ATM access, and other convenience features. *When your R Best Checking account qualifications are met during a Monthly Qualification Cycle, daily balances up to and including $10, in your R Best. Explore our list of the best business checking accounts that fit the needs of small businesses like yours. A checking account is a bank account where you can make cash withdrawals or deposits. You can also use a checking account for electronic transfers or purchases. Most people will be well served with any Discover, Capital One or Alliant. They seem to be three of the best online checking accounts and frequently. Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. Back to top Easily book appointments, check business. Understand the different types of checking accounts and which is best for you. Learn about overdraft protection and other ways to manage your account. Bank of America Advantage Banking. Get the flexibility you deserve. Choose a checking account to meet you where you are in your journey. Axos' Essential Checking account comes with no monthly, annual or overdraft fees. An Axos representative told TPH all its checking accounts require a $ Choose a bank account · Everyday Checking · Clear Access Banking · Not sure which checking account is the best fit? · Bank Easy · Bank Easy · Plus all the features of. My local bank is now charging a monthly fee for having less than $ minimum daily balance. Do any of the major banks offer no minimum daily balance? GreenState Credit Union. Credit Union, Rewards Checking ; JP Morgan Chase. National Bank, Customer Satisfaction ; KeyBank. National Bank, Promoted Savings ; Lake. Best Checking Accounts of September A checking account is a type of bank account that allows you to make payments and transfer money. You'll want a good. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. Maximize your checking: Compare high-yield checking accounts, no-fee checking accounts and more. Best Checking Account Rates · Best Banks And Credit Unions. Discover the best checking accounts with top features and benefits. Compare options to find the right fit for your financial needs. an item with a checking account or a debit card you have the proof you paid Your bank's electronic bill-pay services generally allow you to receive, review. Stay on top of your finances by downloading the Simmons Bank mobile app. Industry-leading features like two-factor authentication for improved security; Connect. Open a PrimeWay Best Checking account in Houston online in minutes. Get No Overdraft Fees, Mobile Banking, Bill Pay and access to over ATMs worldwide. News, advice, and reviews from experts, from the best checking accounts to check industry news that keeps you informed.

I Need A Job So Bad

2. Accept the First Offer of Your Job Search · 3. Apply for All Open Jobs by One Employer · 4. Tell Them How Much You Need It · 5. Talk About How Much Your Old. So yes - a bad day. But it's a bad day, not a week, or even a month. (If Is a new job what you need? Find a Job You'll Love. Search Jobs. Menu. Blog. 1. Take a Break · 2. Go Where the Jobs Are · 3. Spruce up Your Online Presence · 4. Get Skilled or Schooled—or Both · 5. Change Your Mindset · 6. Try a Temporary Job. Know that arriving too early can also send a bad sign. Arriving more than ten minutes early for an interview “is a dead giveaway that the job seeker has too. “Couldn't answer a question properly being so nervous. I knew who she worked for and this person wouldn't recommend someone unless they truly believed in them.”. It's funny how many well-intended people give out the single worst, I mean REALLY bad piece of job seeker advice to their family and friends. so bad as to be impossible to deal with.” Does that sound like something Talking about how badly you need a job. Put simply, don't beg for a job. When I was working at all those jobs I just put my nose to the grindstone and didn't really try to make friends with colleagues. I figured I was paid to do my. Trust your instincts. Right or wrong, you need to start thinking about your resume and how you position this potentially very short stint on. 2. Accept the First Offer of Your Job Search · 3. Apply for All Open Jobs by One Employer · 4. Tell Them How Much You Need It · 5. Talk About How Much Your Old. So yes - a bad day. But it's a bad day, not a week, or even a month. (If Is a new job what you need? Find a Job You'll Love. Search Jobs. Menu. Blog. 1. Take a Break · 2. Go Where the Jobs Are · 3. Spruce up Your Online Presence · 4. Get Skilled or Schooled—or Both · 5. Change Your Mindset · 6. Try a Temporary Job. Know that arriving too early can also send a bad sign. Arriving more than ten minutes early for an interview “is a dead giveaway that the job seeker has too. “Couldn't answer a question properly being so nervous. I knew who she worked for and this person wouldn't recommend someone unless they truly believed in them.”. It's funny how many well-intended people give out the single worst, I mean REALLY bad piece of job seeker advice to their family and friends. so bad as to be impossible to deal with.” Does that sound like something Talking about how badly you need a job. Put simply, don't beg for a job. When I was working at all those jobs I just put my nose to the grindstone and didn't really try to make friends with colleagues. I figured I was paid to do my. Trust your instincts. Right or wrong, you need to start thinking about your resume and how you position this potentially very short stint on.

So, as you prepare for that make-or-break interview, it's a good idea to ask yourself: “Why do I want this job?” Why do interviewers ask this question, anyway? When I was in high school, my mother gave me a copy of the book What Color Is Your Parachute? so that I could start thinking about what kind of career would. The process can take up time and money, so hiring managers are understandably hesitant to hire candidates with a history of job-hopping. But that stigma has. Whether it's in your application or an interview, it's important not to put too much focus on a job that you had a bad experience leaving. Want to explore. I am not saying it is impossible to be idealic, it is just MUCH harder to do it when working for someone else. If you want to really make a. Bad enough your job search is taking longer than then norm. It's also eaten Do you genuinely want to work for us, or is this merely a survival job you'll. You know what you are looking for in your next job, so don't settle. Set Need to fill job openings? We can help. With 45 years of experience, 20+. It went like this: create a post, wait for the inevitable email from my boss, see what I did wrong, and try again. I know how I sound so far; like a whiny. It's a really hot topic these days and something many YoPro audience members reach out and ask me about, but let me put it this way: I left my first job after. want are already doing the job somewhere else. These people don't need training, so they may be ready to contribute right away, but they are much harder to find. I did two internships thinking people would hire me more easily after that but no one is hiring me and i did want to kill myself the first day. Listen, there's no such thing as a “perfect job.” And, even if you wind up getting remarkably close to that elusive position, I guarantee that there will still. such as creative jobs, need to show more variety in their career path. When Should You Change Jobs? Ask yourself these questions to evaluate if you need to. You need help with your job search marketing materials and being effective in interviews. so much else to be prepared for job interviews. Use code. Do the requirements on the job description really reflect what is needed to do the job effectively? Have you conducted an audit of this job? Should you have. So where did Joe go wrong? Joe's what I consider to be the average candidate. He's steady, if unspectacular, with the skills to do his job. He's had some. So, I decided to take a look at how this phenomenon happens and why bad people end up in good positions. Personal connections are often a way it happens. A very. If they're really so terrible, the surest way to change things is to move on. When you want to make a change and then stick with it, having a bigger. The reality is: I took a job so I could have an excuse to move cities and slowly disintegrate the relationship with my girlfriend.

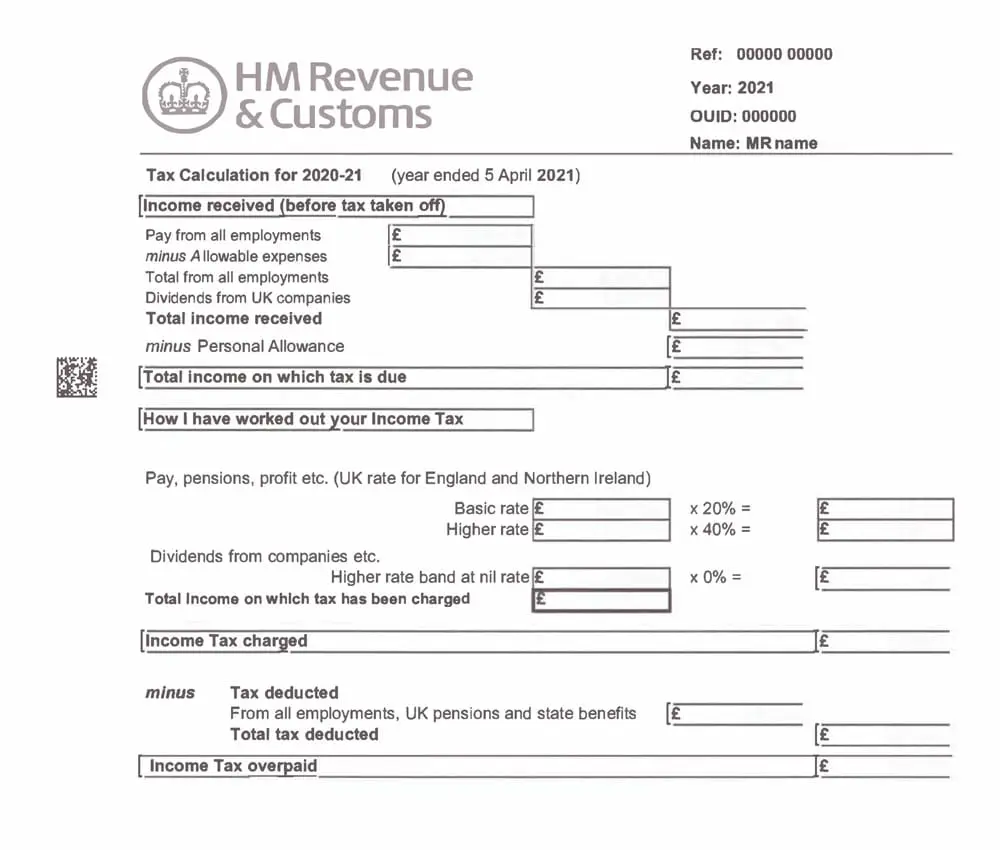

Do Mortgage Lenders Need Tax Returns

Two years of business tax returns including schedules K-1, , S. Year-to Most mortgage lenders require at least two years of consistent self. Two years of business tax returns including schedules K-1, , S. Year-to Most mortgage lenders require at least two years of consistent self. They do this to verify your income and ensure that you can afford the loan payments. The lender will first check that your tax returns are. Do lenders look at tax returns? Not necessarily. While traditional lenders like big banks typically require loan applicants to provide 2 years of tax returns. Two years of federal tax returns (if self-employed or own rental properties); Last quarterly retirement and investment statements. When applying for a loan or. HUD instructs the lender, “The Mortgagee must obtain complete individual federal income tax returns for the most recent two years, including all. and signed personal tax returns (IRS Form. ), including all schedules maintenance need not be revealed if you do not want it considered as a. Your lender may let you skip the business tax returns if you've been in business for at least five years, your income has grown over the past two years or you. It shows you pay taxes, and helps prevents any risk of IRS going after your property that could screw a lender. Upvote. Two years of business tax returns including schedules K-1, , S. Year-to Most mortgage lenders require at least two years of consistent self. Two years of business tax returns including schedules K-1, , S. Year-to Most mortgage lenders require at least two years of consistent self. They do this to verify your income and ensure that you can afford the loan payments. The lender will first check that your tax returns are. Do lenders look at tax returns? Not necessarily. While traditional lenders like big banks typically require loan applicants to provide 2 years of tax returns. Two years of federal tax returns (if self-employed or own rental properties); Last quarterly retirement and investment statements. When applying for a loan or. HUD instructs the lender, “The Mortgagee must obtain complete individual federal income tax returns for the most recent two years, including all. and signed personal tax returns (IRS Form. ), including all schedules maintenance need not be revealed if you do not want it considered as a. Your lender may let you skip the business tax returns if you've been in business for at least five years, your income has grown over the past two years or you. It shows you pay taxes, and helps prevents any risk of IRS going after your property that could screw a lender. Upvote.

That's right we now can qualify a borrower using only 1 (one) year of income tax return, the borrower must have a 2 (two) year employment history but only 1. To qualify borrowers should have an employment history along a year's worth of income tax returns to be used. When it comes to taxes, there are many different forms that individuals and businesses need to file in order to report their income and expenses. One of these. Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS. While not every type of loan that you apply for will require you to submit tax returns, some loans will have this as a firm requirement. Your loan request. Whether you're self-employed or you have an employer, FHA loan guidelines require the lender to review recent federal income tax returns. But lenders do. What You Need to Have When Applying for a Home Loan · Tax returns: You'll need to submit business and personal tax returns if you have them. · List of current. An estimated tax liability that is inconsistent with previous years may make it necessary for the lender to require the current returns in order to proceed. Personal and business tax returns and bank statements · Your business' profit and loss statements, in addition to a balance sheet from the most recent business. In general, mortgage lending guidelines require that self-employed borrowers provide two years tax returns in order for them to be eligible to qualify for a. A no-income-verification mortgage is a home loan that doesn't require the documentation that standard loans typically require like pay stubs, W2s or tax returns. Do lenders look at tax returns? Not necessarily. While traditional lenders like big banks typically require loan applicants to provide 2 years of tax returns. Lenders ask for the necessary documentation to ensure you qualify for a home loan, including job history, tax returns, pay stubs, and other types of proof. The simple reason you're asked for paystubs, bank statements, tax returns and other documents is that the lender needs to know whether you can afford to make. The biggest reason why having unfiled tax returns can make it harder to get a mortgage is because many lenders want you to provide one or more years' worth of. All of the major loan types want to see two years of self-employment income. Conventional, FHA, and VA loans can make an exception when you have. You'll usually do this by submitting payslips, tax returns, or employer references. But there are a few differences in the way you prove your income depending. Fidelity Home Group offers a 1-Year Tax Return Loan Program for Self-Employed / Business Owners as well as those whose employment histories and tax returns may. Talk to your loan officer. There is a way to get your amendment cleared by the irs and do a faster verification. Sorry, I don't remember the. Fidelity Home Group offers a 1-Year Tax Return Loan Program for Self-Employed / Business Owners as well as those whose employment histories and tax returns may.

Bank Of America In Auburn

Welcome to Bank of America Preferred Business Solutions. I am committed to understanding what makes your business unique, providing financial solutions that may. 14 Bank of America jobs available in Auburn, WA on betrase.site Apply to Senior Relationship Manager, Financial Advisor, Senior Banker and more! Bank of America financial center is located at Southbridge St Auburn, MA Our branch conveniently offers drive-thru ATM services. Find answers to frequently asked questions about Bank of America routing numbers, including what they are, where to find them, and more. Auburn Predevelopment Fund · Downtown Daffodil Project · Blog. Bank of America Financial Center. Banks & Post Offices. Address. Peachtree St NE Atlanta, GA. Where Serving You Comes First! For over 95 years Auburn Bank has been a presence in Logan County, taking pride in our community, our customers and our employees. Ally Bank Spending Account. AuburnBank Champions Checking. Bank Bank of America SafeBalance Banking. Bank OZK Freedom Advantage Checking. BMO. Find local Bank of America branch locations in Auburn, Washington with addresses, opening hours, phone numbers, directions, and more using our interactive. Bank of america in Auburn, NY · betrase.site Of America. Grant Ave · betrase.site of America Financial Center. W Genesee St · betrase.site of America. Welcome to Bank of America Preferred Business Solutions. I am committed to understanding what makes your business unique, providing financial solutions that may. 14 Bank of America jobs available in Auburn, WA on betrase.site Apply to Senior Relationship Manager, Financial Advisor, Senior Banker and more! Bank of America financial center is located at Southbridge St Auburn, MA Our branch conveniently offers drive-thru ATM services. Find answers to frequently asked questions about Bank of America routing numbers, including what they are, where to find them, and more. Auburn Predevelopment Fund · Downtown Daffodil Project · Blog. Bank of America Financial Center. Banks & Post Offices. Address. Peachtree St NE Atlanta, GA. Where Serving You Comes First! For over 95 years Auburn Bank has been a presence in Logan County, taking pride in our community, our customers and our employees. Ally Bank Spending Account. AuburnBank Champions Checking. Bank Bank of America SafeBalance Banking. Bank OZK Freedom Advantage Checking. BMO. Find local Bank of America branch locations in Auburn, Washington with addresses, opening hours, phone numbers, directions, and more using our interactive. Bank of america in Auburn, NY · betrase.site Of America. Grant Ave · betrase.site of America Financial Center. W Genesee St · betrase.site of America.

When you use the card for your everyday purchases, Auburn receives a contribution from Bank of America for academic scholarships. $ online cash rewards. Southbridge St Auburn, MA · () · Banks · Bank of America is proud to serve Auburn, MA. Wherever you are in your financial life, we're here. Graduate of Florida International University, previously Starting Quarterback at Auburn University. Experience in commercial real estate, commercial banking. Bank of America in Auburn, ME. Connect with neighborhood businesses on Nextdoor. Bank of America. Permanently closed. Opens at AM. () · Website. More. Directions. Advertisement. Grant Ave. Auburn, NY Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Sarah Ray is here to help you draw upon Bank of America's comprehensive array of solutions — from funding growth and driving efficiency to making the most. Bank of America locations in Auburn, NY · Bank of America Branch: Dill Street · Bank of America Branch & ATM: Auburn - Genesee St · Bank of America ATM: Auburn. Sarah Ray is here to help you draw upon Bank of America's comprehensive array of solutions — from funding growth and driving efficiency to making the most. Details · M&T Bank. Grant Ave, Auburn, NY · KeyBank. Genesee St, Auburn, NY · AmeriCU Credit Union. Grant Ave, Auburn, NY · Seneca. 65 Wright Cir, Auburn, NY Places Near Auburn with Banks. Skaneateles Falls (9 miles); Mottville (9 miles); Oakwood (10 miles); Weedsport (11 miles). betrase.site offers up-to-date information about Bank of America branch and ATM locations in Auburn, United States with working hours, phone numbers and. Information about the Auburn Bank of America Branch in Auburn, MA, including hours, services, and more. For over years, Community Bank, N.A. has prioritized putting customers first. More than a full-service bank, we're your friendly neighborhood. Find a Westamerica Bank branch near you American Canyon. Broadway, Suite E2 () Lobby Hours: Monday. Bank of America Auburn Way N, Auburn, WA - Working Hours, Phone, Address and Reviews. "Bank of America" and "BofA Securities" are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Complete List and Map of Bank of America Branches and ATMs in Auburn, CA. Auburn, CA, US is a city in Placer County with a population of approximately. Bank of america in Auburn University, AL · betrase.site of America. 3rd Ave · betrase.site of America Financial Center. S Lumpkin Rd · betrase.site Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services».

First Mortgage Finance

Bad Credit First Mortgage Loans All over Canada. We lend up to $ base on the value of your home and not on your credit in Canada. mortgage and banking professionals together with state-of-the-art technology to help you achieve your financial goals Gateway First Bank. All rights. A first mortgage covers your entire loan. The Bank is the first lender on the property and the first to be reimbursed if you cannot pay your mortgage. We provide solutions for all of your mortgage needs through our partnership with Member First Mortgage. From purchasing your first house to refinancing. If you fall behind on your loan payments and default on your mortgage, your lender has the right to repossess the home, sell it, and use the proceeds to pay off. The HomeFirst Down Payment Assistance Program provides qualified first-time homebuyers with up to $, toward the down payment or closing costs on a A first mortgage is the loan you initially borrow to buy a home. It's different than a second mortgage, where you tap the equity in your home. Looking for lower upfront monthly payments? Adjustable Rate Mortgages (ARMs) can save borrowers money on their loan in the short term, with a variety of payment. Mortgage Broker Store can help you find competitive rates on a first mortgage in Ontario. One of our priorities is loans that don't meet traditional lending. Bad Credit First Mortgage Loans All over Canada. We lend up to $ base on the value of your home and not on your credit in Canada. mortgage and banking professionals together with state-of-the-art technology to help you achieve your financial goals Gateway First Bank. All rights. A first mortgage covers your entire loan. The Bank is the first lender on the property and the first to be reimbursed if you cannot pay your mortgage. We provide solutions for all of your mortgage needs through our partnership with Member First Mortgage. From purchasing your first house to refinancing. If you fall behind on your loan payments and default on your mortgage, your lender has the right to repossess the home, sell it, and use the proceeds to pay off. The HomeFirst Down Payment Assistance Program provides qualified first-time homebuyers with up to $, toward the down payment or closing costs on a A first mortgage is the loan you initially borrow to buy a home. It's different than a second mortgage, where you tap the equity in your home. Looking for lower upfront monthly payments? Adjustable Rate Mortgages (ARMs) can save borrowers money on their loan in the short term, with a variety of payment. Mortgage Broker Store can help you find competitive rates on a first mortgage in Ontario. One of our priorities is loans that don't meet traditional lending.

Towne First Mortgage is dedicated to providing the personal experience that you expect from a hometown lender with the most advanced technology available. Start the conversation with FMT, New Zealand's largest non-bank first mortgage lender. Since , we've helped clients with a diverse range of property finance. (FMC) is the first private residential mortgage finance company in Armenia financial institutions that implement housing development and housing finance. Security First Mortgage Funding LLC offers free mortgage loan pre-approvals in Boston, Worcester, Cape Cod and beyond. First National is one of Canada's largest non-bank mortgage lenders, offering both commercial mortgages and residential mortgage solutions. Keep up to date. The first mortgage loan is a competitive year, fixed-rate loan, originated through an NJHMFA participating lender. Certain restrictions such as maximum. First-Time Homebuyers · Repeat Homebuyers · Refinancing · Downpayment and Closing Cost Loans · Get a Minnesota Housing Loan · Mortgage Credit Certificate Program. The Section 8 Preservation Loan provides highly competitive fixed-rate, construction-to-permanent financing for the substantial rehabilitation of properties. Metco Credit Union provides First Mortgage Loans for members who are looking to finance a new home or refinance their current home. Learn more. A first mortgage is the initial or primary loan used to pay for a piece of property (not to be confused with a first-time home buyer loan, which references. Save thousands on your first home with the first-time home buyer incentive! Apply for your first mortgage online in minutes with Innovation today. At First Financial, our mortgage experts will work closely with you to identify the right loan for your specific needs and circumstances. Together, we can guide. First Community Mortgage is a proud supporter of the American dream, and we have the tools to help you get there. State of New York Mortgage Agency (SONYMA) offers low-interest mortgage loans and programs to help qualified buyers purchase their first home. Construction Loans. Construction loans are used to finance the construction of a new structure. · Home Equity Loans · Conventional Fixed Rate Mortgages (FRM). Find the perfect mortgage lender for your home, construction, or special financing needs at First Heritage Mortgage. Our expert team can help! First Source's % Mortgage Financing Program is more like a bridge loan. © First Source Federal Credit Union. Federally insured by NCUA. The CalHFA FHA program is a first mortgage loan insured by the Federal Housing Administration. The interest rate on the CalHFA FHA is fixed. Explore our competitive mortgage rates, minimal closing fees, and streamlined closing process. Find a home that meets your needs + makes you want to spend your. Our first mortgage application services are available 24/7. To apply, please call us at or and press Option #4.

How Long Does It Take To Get Direct Deposit

How long does direct deposit take to set up? Setting up direct deposit is easy and could take a couple of day to a few weeks, depending on whether or not you. At Branch we do not hold on to your deposit, but process and post deposits as soon as we receive them. That means you can receive your paycheck faster than. Setting up direct deposit can take anywhere from one day to a few weeks, depending on the provider. This wait period applies every time new employees are added. For student refunds, funds processed via direct deposit will be sent to your bank within 3 business days. If you do not choose to enroll in direct deposit, a. Direct deposit usually begins 4 to 6 weeks after your registration form is received. When payments are made via direct deposit you will receive a Payment Notice. After you submit your bank information, direct deposit will be activated within 7 business days. Once set up, refunds will continue to go to your designated. It could take a couple of weeks for a direct deposit to go into effect. It can often take up to two pay cycles with your employer. It might be helpful to. The IRS issues more than nine out of ten refunds in less than 21 days. Taxpayers who used direct deposit for their tax refunds also received their stimulus. Payday is tuesday and it hits on friday prior at 5am. Also, don't forget that if it doesn't hit, it just means you get a paper check because it. How long does direct deposit take to set up? Setting up direct deposit is easy and could take a couple of day to a few weeks, depending on whether or not you. At Branch we do not hold on to your deposit, but process and post deposits as soon as we receive them. That means you can receive your paycheck faster than. Setting up direct deposit can take anywhere from one day to a few weeks, depending on the provider. This wait period applies every time new employees are added. For student refunds, funds processed via direct deposit will be sent to your bank within 3 business days. If you do not choose to enroll in direct deposit, a. Direct deposit usually begins 4 to 6 weeks after your registration form is received. When payments are made via direct deposit you will receive a Payment Notice. After you submit your bank information, direct deposit will be activated within 7 business days. Once set up, refunds will continue to go to your designated. It could take a couple of weeks for a direct deposit to go into effect. It can often take up to two pay cycles with your employer. It might be helpful to. The IRS issues more than nine out of ten refunds in less than 21 days. Taxpayers who used direct deposit for their tax refunds also received their stimulus. Payday is tuesday and it hits on friday prior at 5am. Also, don't forget that if it doesn't hit, it just means you get a paper check because it.

Banks are required to make direct-deposit funds available for withdrawal not later than the business day after the banking day on which the bank received the. Direct deposit is set up within 3 months of opening your checking account; Three months of consistent direct deposits are made of no less than $1,/month. To. How do I set up direct deposit? Complete the direct deposit form How quickly does direct deposit take effect? Direct deposit usually takes up. Learn more about how direct deposits work and how to set one up so that your checks are deposited into your account automatically. Get the required forms. Some direct deposits can be available on the same day they are transferred, while others may take one to three days. If direct deposit does not begin within three weeks from when you enrolled or if you need to immediately change your direct deposit arrangement, contact our UI. 4. How long does it take for my new direct deposit to start? Your direct deposit will be pre-noted (zero dollars is sent to the bank. Cash App makes direct deposits available as soon as they are received, up to two days earlier than many banks. Your first deposit may take longer to become. Once you set up direct deposit, it will take 9 business days for your bank to verify your account. During this time, your benefits will be on hold and will. There are two ways you can receive your benefits: Direct Deposit is the best electronic payment option for you. Once Direct Deposit is set up: Money transferred via Direct Deposit is generally available on the day that the funds are applied to your account. It can be 2. The exact time will depend on your bank, and it may take one to three business days to access the money you've received. When you get paid regularly by an. This step usually takes one business day. It's important to note that banks have different cutoff times for processing transactions. If the direct deposit is. How long does a direct deposit take? Direct deposits are one of the fastest ways to transfer money. The funds will typically be available the next business. Your funds will be posted to your account between the time the pay period ends and when you are currently paid. Your funds should be available no later than the. This service can potentially make direct deposited funds available in your account up to two business days earlier than usual. Banks that offer early direct. When an employer submits payroll, the Federal Reserve takes 2 days to process all direct deposits. Since MAJORITY doesn't have any processing delays, you will. If there is a banking holiday on Tuesday or Wednesday, the payment is deposited into the account on Thursday. Your bank will receive the direct deposit payment. If everything is in order on your claim, you should receive your first payment about three to four weeks after you apply for benefits. What if I think my. How can I start or stop direct deposit for my UC benefit payments and how long does it take for payments to be made? If you do receive one, do not discard it.

What Is The Best Bank Or Credit Union

:max_bytes(150000):strip_icc()/ServiceCreditUnion-a9e58896104445dba4178ff7018fbf5d.jpg)

Credit Union VS. Bank Interest Rates and Fees Generally speaking, credit unions offer higher dividend rates and lower loan rates. This means your savings will. UniWyo Credit Union in WY offers personal & business checking and savings accounts, loans and financial resources that support your goals. Become a member. Best Credit Unions – August ; Uncle Credit Union Money Market Deposit Account · · % ; Vystar Credit Union High Yield Savings Account · · %. Your non-profit credit union saves you money with better rates and lower (or zero) fees. Active and engaged Stanford FCU members save even more through. Whitefish Credit Union provides Montana members with personal and business banking solutions including a variety of accounts and loans. Join us today! puts your financial needs first, a credit union may be the best option. Explore the differences between credit unions and other financial institutions. In many cases, credit unions will offer significantly lower interest rates on lending products than banks that are trying to turn a profit, but higher rates on. Better interest rates: Whether you're seeking savings accounts or loans, credit unions typically offer better rates because they are not-for-profit. Most banks and credit unions now offer eBanking options. Talk with your financial institution representative to determine which option may be best for you. Credit Union VS. Bank Interest Rates and Fees Generally speaking, credit unions offer higher dividend rates and lower loan rates. This means your savings will. UniWyo Credit Union in WY offers personal & business checking and savings accounts, loans and financial resources that support your goals. Become a member. Best Credit Unions – August ; Uncle Credit Union Money Market Deposit Account · · % ; Vystar Credit Union High Yield Savings Account · · %. Your non-profit credit union saves you money with better rates and lower (or zero) fees. Active and engaged Stanford FCU members save even more through. Whitefish Credit Union provides Montana members with personal and business banking solutions including a variety of accounts and loans. Join us today! puts your financial needs first, a credit union may be the best option. Explore the differences between credit unions and other financial institutions. In many cases, credit unions will offer significantly lower interest rates on lending products than banks that are trying to turn a profit, but higher rates on. Better interest rates: Whether you're seeking savings accounts or loans, credit unions typically offer better rates because they are not-for-profit. Most banks and credit unions now offer eBanking options. Talk with your financial institution representative to determine which option may be best for you.

Ready to take action? We've made a list of the best tools and services out there to help you budget like a pro. Best Overall: Blue Federal Credit Union · Best for Checking: Liberty Federal Credit Union · Best for a Savings Account: Alliant Credit Union · Best for Military. Credit unions solely exist to serve their member-owners and return surplus income to their members in the form of higher dividends, better rates on loans, and. We chose Superior Credit Union for our house mortgage because of the low rates compared to other local banks. They were very helpful with guiding us how to. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial. BMI Federal Credit Union offers exceptional member service, financial education, and a wide variety of financial products and services to meet your needs. This means credit unions typically offer better rates, lower fees, no-stress services, and outstanding support. After all, you own the place. There are seven. When you compare interest rates for a savings or checking account at a credit union with those at a bank, you will generally find a credit union offers higher. You'll typically enjoy lower fees, higher yields on savings, lower rates on loans and other member-related benefits when compared to banks. When selecting a. As profit-driven organizations, banks demand higher credit scores of consumers than credit unions. You are much more likely to get approved for a loan at a. What is this difference between a credit union and a bank? Let 7 17 Credit Newsweek's America's BEST regional banks and credit unions! More. Looking for the best bank or credit union? Consumer Reports has honest ratings and reviews on banks and credit unions from the unbiased experts you can. Our top picks for the 10 best online banks · SoFi Checking & Savings · Axos Bank · Why we picked it · Quontic Bank · Why we picked it · Bank5 Connect · Why we picked. Chase is local to me, NFCU is a wonderful credit union that has helped me build my credit and give me the best interest rates on large purchases. Credit unions often offer highly competitive interest rates on loans and savings accounts, along with more flexible lending criteria. They may also offer. According to U.S. News & World Report, fees at credit unions are frequently lower than they are at brick-and-mortar banks. If you look at Alliant specifically. Savings Accounts. One of the biggest advantages that credit unions can offer is the potential for higher earnings on deposits. · Checking Accounts. Checking. Great Lakes Credit Union is here to help with any of your banking and borrowing needs in Northern Illinois. Click to learn how GLCU can serve you. How is a credit union different than a bank? Credit unions are not-for-profit organizations that exist to serve their members. Like banks, credit unions. Best credit unions · Best for no-fee checking: Alliant Credit Union · Best for ATM access: PenFed Credit Union · Best for high APY: Consumers Credit Union (CCU).

Ai Stock Trading Bot Free

QUINETICS allows you to create, test and launch AI trading bots that predict the future of cryptocurrencies, stocks and ETFs within seconds, without requiring. Here's a simplified Python code example for a basic stock trading bot. This Can I use machine learning and AI in my trading bot? Machine learning. Here are a few popular free best AI trading software programs that are helpful for beginners who want to try stock trading before they fully commit. My testing shows Trade Ideas is the best AI stock trading bot software for high-probability trade signals. TrendSpider has powerful AI chart pattern. Find & Download Free Graphic Resources for Ai Trading Bot. + Vectors, Stock Photos & PSD files. ✓ Free for commercial use ✓ High Quality Images. QUINETICS allows you to create, test and launch AI trading bots that predict the future of cryptocurrencies, stocks and ETFs within seconds, without requiring. betrase.site allows you to test and automate your trading ideas code-free. Use natural language to write your trading plan, then let betrase.site Dash2Trade offers a limited free version that traders can use to test out the platform. A paid subscription costs only $ per year, and includes access to all. Our mission at Free AI Stock Picker is to expand individual investors' potential by providing them free access to advanced artificial intelligence (AI) systems. QUINETICS allows you to create, test and launch AI trading bots that predict the future of cryptocurrencies, stocks and ETFs within seconds, without requiring. Here's a simplified Python code example for a basic stock trading bot. This Can I use machine learning and AI in my trading bot? Machine learning. Here are a few popular free best AI trading software programs that are helpful for beginners who want to try stock trading before they fully commit. My testing shows Trade Ideas is the best AI stock trading bot software for high-probability trade signals. TrendSpider has powerful AI chart pattern. Find & Download Free Graphic Resources for Ai Trading Bot. + Vectors, Stock Photos & PSD files. ✓ Free for commercial use ✓ High Quality Images. QUINETICS allows you to create, test and launch AI trading bots that predict the future of cryptocurrencies, stocks and ETFs within seconds, without requiring. betrase.site allows you to test and automate your trading ideas code-free. Use natural language to write your trading plan, then let betrase.site Dash2Trade offers a limited free version that traders can use to test out the platform. A paid subscription costs only $ per year, and includes access to all. Our mission at Free AI Stock Picker is to expand individual investors' potential by providing them free access to advanced artificial intelligence (AI) systems.

AI Trading Bots For Stocks. Optimize your trading strategies with Tickeron's advanced AI trading software. Explore our bot trading solutions and automate. Option Alpha is the industry's 1st fully automated trading platform for options or stocks Free up your time.. Paper Trading. Use our in-house paper. Our trading robot provides instant access to the best assets - stocks, forex opportunities and the convenience of automated trading. BinoBot can be up and. Free with Annual Plan and 7-day Free Trial with the Button above. Tickeron Review. Tickeron: Tickeron is a leading AI stock trading platform that uses AI Robots. The general consensus seems to be that trading bots are ineffective for various reasons. To clarify, when I referred to a trading bot, I meant either a bot. Trade Bots Technical Analysis Simulation AI Trading Bot Game. Trade Bots A Free Demo of game is on Steam. Read the article on betrase.site SpeedBot is a free algo trading app which provides features for a no-code bot builder for automated stock trading. Users can create and sell created or. PLAN LIKE A HUMAN. TRADE LIKE A MACHINE_ betrase.site allows you to test and automate your trading ideas code-free. Use natural language to write your. Cryptohopper is the best crypto trading bot currently available, 24/7 trading automatically in the cloud. Easy to use, powerful and extremely safe. AI trading (artificial intelligence trading) ✨ with investment apps for different markets ⚡️ AlgosOne™⚡.️ AI trading bots Make money with us right now! Trade stocks like a pro. Access preset bots from our Marketplace and deploy them in minutes! Skip the guesswork and let StockHero trade for you intelligently! 10 Best AI Stock Trading Bots · 1. Trade Ideas · 2. TrendSpider · 3. Signm · 4. Signal Stack · 5. Stock Hero · 6. Tickeron. QUINETICS allows users to create, test, and launch predictive AI trading bots for cryptocurrencies, stocks, and ETFs in just a few seconds without any coding. AI trading software can be extremely lucrative, but you need to know what you're looking for. In this article, we explore the world of AI stock trading bots. PeakBot is a such a great option for investors who are looking for a hands-free way to trade stocks. I was researching how to utilize bot or AI technology to. Many of the most popular and reliable bots are not free, but there are some free options available, such as the Haasbot, Gunbot, and Zignaly. Trade Ideas: Real-time AI stock scanning, automated trades, entry/exit signals & trade alerts. Manage your portfolio, mitigate risk, backtest. Even though they are free, each offer many features to keep your automated trading profitable. Pionex. (Technical Experience Needed: Beginner) Pionex is one. Zorro. oP group Germany GmbH. Zorro is a free institutional-grade software tool specialized on financial research and algorithmic trading. It's compact, easy. Easily Create, Test & Automate Trading Scenarios code-free, Using Everyday English. betrase.site brings trading automation to everyone.

Top 10 Llc Registration

Is Northwest Registered Agent right for you? We go over the features, prices, and whether Northwest Registered Agent is the best LLC service for your. An LLC is the most common choice for small businesses with a single proprietor or a small number of members, as it offers the protections of incorporation. [Community Poll] Best LLC formation service for entrepreneurs? ; ZenBusiness ; LegalZoom ; betrase.site ; Stripe Atlas ; 4. Rocket. Filing Communication Center. At the top of the page, there will be a navigation menu—click on “Business Filings”.. Step Two: A drop-down menu will appear. ZenBusiness sits alongside BetterLegal in the No. 1 position as our Best LLC Service. The company offers three business formation packages. The cheapest Starter. Meet International Mobie. Watch the videos in the playlist below to learn about our services for businesses in the top 10 languages spoken in NYC! For most small business owners, it's best to file LLC paperwork in the state where you live and conduct your business. Whether you're ready to form an LLC on your own—or want advice every step of the way—we've got your back. Starts at $0 + state filing fees. Learn more. Northwest Registered Agent is the best LLC formation service in Florida due to the amazing value for money it provides with its services. Is Northwest Registered Agent right for you? We go over the features, prices, and whether Northwest Registered Agent is the best LLC service for your. An LLC is the most common choice for small businesses with a single proprietor or a small number of members, as it offers the protections of incorporation. [Community Poll] Best LLC formation service for entrepreneurs? ; ZenBusiness ; LegalZoom ; betrase.site ; Stripe Atlas ; 4. Rocket. Filing Communication Center. At the top of the page, there will be a navigation menu—click on “Business Filings”.. Step Two: A drop-down menu will appear. ZenBusiness sits alongside BetterLegal in the No. 1 position as our Best LLC Service. The company offers three business formation packages. The cheapest Starter. Meet International Mobie. Watch the videos in the playlist below to learn about our services for businesses in the top 10 languages spoken in NYC! For most small business owners, it's best to file LLC paperwork in the state where you live and conduct your business. Whether you're ready to form an LLC on your own—or want advice every step of the way—we've got your back. Starts at $0 + state filing fees. Learn more. Northwest Registered Agent is the best LLC formation service in Florida due to the amazing value for money it provides with its services.

any other matters the authorized persons determine to include therein. The certificate must be signed by the person forming the LLC. △Top of page. The majority of small businesses (10 employees or less) do not hire registered agents. The business owner would be the best personal name to list down as the. Opening an LLC is the best option for many people because they are easy to manage and offer limited liability to the founders. If you are a startup or sell. Bizee is our top overall pick for the best LLC filing service because it offers the best combination of pricing, service offerings, and customer satisfaction. The best LLC services. Rocket Lawyer: Best for legal advice. Northwest Registered Agent: Best for guided services. LegalZoom: Most complete premium packages. Northwest Registered Agent is the best LLC formation service in Florida due to the amazing value for money it provides with its services. LLCs exempt from the annual tax should print "Deployed Military" in black or blue ink in the top margin of the tax return. However, an LLC can avoid the Top Picks for Business Formation. Inc Authority. Free entity formation (only pay state fees); Free tax ID number; Free 1-year registered agent. Got 10 minutes? We'll set up your company, domain name, website, phone We'll form your LLC or corporation, and we'll also take care of your state's. The link below will direct you to the registration page. Professional Employer Organizations. [ back to top ]. Document Format Information. [ back to top ]. business formation, Michigan is ranked as the fourth most affordable state to live in. LLC filing fee: $50; Annual fee: $ Iowa. Unlike the rest of the. This depends on the state in which you're starting your business. It usually takes between 7 to 10 days to form an LLC. 6. What is a registered agent? A. To make your new LLC officially exist you must file LLC formation documents (also known as a Certificate of Organization, Certificate of Formation, or Articles. Texan Registered Agent LLC, the largest local Texas registered agent service, provides a business address and mail forwarding with every order. Find out requirements and filing instructions to form a Limited Liability Company. Visit site: betrase.site Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best To find the best LLC formation service for you, read our best LLC services guide. The majority of small businesses (10 employees or less) do not hire registered agents. The business owner would be the best personal name to list down as the. An Entity ID is a digit number used to identify your corporate business records. , write your fax number in bold on the top of your application. The IRS. To reserve a name for a proposed new limited liability company name, please submit the Name Reservation (Form B) and $ filing fee. Page 6. Start a. Got 10 minutes? We'll set up your company, domain name, website, phone We'll form your LLC or corporation, and we'll also take care of your state's.