betrase.site

Gainers & Losers

Hdpe Bottle Caps

HDPE plastic bottles with a volume of ml are suitable for storing and transporting liquid substances in the food, chemical, drug or petrochemical. These clear, reusable plastic bottles make dispensing paint easy. VERSATILITY OF FOOD GRADE SAFE BOTTLE: It makes cooking and baking so much easier by using. A range of PP dropping bottle caps for use in conjunction with the Wheaton dropping bottles and tips to provide a complete solution. AP22 HDPE Crown Cap Bottle · Cap Type: Screw Cap · Color: White · Use For Storage: Chemical · Capacity: ml, ml, ml & ml · Flexibility: Hard · Material. *Caps and closures sold separately. -- Scroll down below to view recommended caps. Product Specifications. 10 ml HDPE Bottle, White with Interchangeable Caps - - - Automatic Seal - Caps feature a built-in liner that seals to the bottle without the need for special equipment. UV Protection - Amber HDPE bottle protects light. The 38mm cap is a HDPE tamper evident closure for PET Bottles. Available to buy now From GT Online for food grade products including milk, kefir and juice. PET will sink, PP and HDPE will float. Both materials are then recycled into new items. Page 2. Should bottles and containers be flattened. HDPE plastic bottles with a volume of ml are suitable for storing and transporting liquid substances in the food, chemical, drug or petrochemical. These clear, reusable plastic bottles make dispensing paint easy. VERSATILITY OF FOOD GRADE SAFE BOTTLE: It makes cooking and baking so much easier by using. A range of PP dropping bottle caps for use in conjunction with the Wheaton dropping bottles and tips to provide a complete solution. AP22 HDPE Crown Cap Bottle · Cap Type: Screw Cap · Color: White · Use For Storage: Chemical · Capacity: ml, ml, ml & ml · Flexibility: Hard · Material. *Caps and closures sold separately. -- Scroll down below to view recommended caps. Product Specifications. 10 ml HDPE Bottle, White with Interchangeable Caps - - - Automatic Seal - Caps feature a built-in liner that seals to the bottle without the need for special equipment. UV Protection - Amber HDPE bottle protects light. The 38mm cap is a HDPE tamper evident closure for PET Bottles. Available to buy now From GT Online for food grade products including milk, kefir and juice. PET will sink, PP and HDPE will float. Both materials are then recycled into new items. Page 2. Should bottles and containers be flattened.

I-Chem HDPE bottle caps with LDPE foam, bulk pack, cap. show Variants. item number: item number old: manufacturer number. RF 2APP4N2–Bottle caps made of HDPE (high-density polyethylene) segregated according to the colors prepared for recycling. heart_plus. download shopping_cart. 15ml HDPE Bottle + Cap (Pack of ) – Natural Manufactured to precise specifications with a narrow mouth ideal for pouring liquids. All HDPE bottles are. The material normally used to make bottle caps is Polyethylene. Most caps, you can feel them as a bit stiff, are made of HDPE, High Density. MODERN ROUND PLASTIC BOTTLES - HDPE WITH SPOUT CAPS, buy glass bottles, plastic bottles, jars, and closures by the case online at wholesale prices. WHY betrase.site? Browse from Hundreds of Plastic Bottles & Glass Bottle Choices. Read More. Plastic bottles, glass bottles, plastic jars, glass jars. Store fluids and powders safely in this user-friendly betrase.site: no cap is included. Sets, Bottles/Caps: cc HDPE Round Packer Bottles With A Fine Ribbed Cap, Includes A Foam Liner; By Alpha. star Best Value. Manufacturer: ALPHA. 31, Note: When purchasing caps for your bottles, testing is advised. We cannot guarantee a leak-proof fit with every bottle/cap combination. HDPE bottle. Diamond Essentials Bottle, Narrow Mouth, Boston Round, HDPE with PP Closure, 60mL, Bulk Packed with Bottles and Caps Bagged Separately, /Case. BKS. Wheaton cap for 1 L HDPE bottle pkg of ea; find -Z MSDS, related peer-reviewed papers, technical documents, similar products & more at. Set of 6 1L HDPE bottles recommended for Ion Chromatography analysis. Includes solid polypropylene caps for solvent storage when not in use. For connection to. A range of PP dropping bottle caps for use in conjunction with the Wheaton dropping bottles and tips to provide a complete solution. Natural HDPE Bottles with Yorker Caps and Red Tips Yorker Top Bottles with Red Tip are supplied with LDPE Yorker cap and red tip attached. These bottles are. Available colour shades. Material. We make caps from primary HDPE material (High Density Polyethylene), which meets all material requirements for direct contact. Polyethylene Terephthalate (PET) is non-toxic, light in weight, strong and durable, environmentally friendly and recyclable. It is used in plastic bottles that. Hazmatpac distributes a complete line of pressure tested lab grade quality narrow and wide mouth HDPE plastic bottles. The bottles feature a superior. Nalgene® IP2 HDPE Bottle with Cap, 8 oz. Capacity, 43/ Mouth Qty. Price $Your Price$ 8oz HDPE Plastic Squeeze Bottles with Wide Mouth Opening, Black Flip Top Caps for Condiments and Any Thick Liquid Products, Multi Purpose Refillable Empty. Bottle caps. Caps & Closures. Home · Markets · Rigid Packaging; Caps & Closures. Polyethylene; Polypropylene. TotalEnergies exhaustive Caps & Closures.

How To Report Rent Payments

It's an optional, fee-based service that residents can easily sign up for and pay for through Buildium Resident Center. Each month, Rent Reporting will. There are a few ways for a landlord or property manager to get a tenant's poor payment behavior to show up on the tenant's credit report and alert future would. With FrontLobby, Landlords or Property Managers can easily report rental payments to Equifax. When a Tenant pays rent on time, the amount is reported to Equifax. Win-win ancillary revenue. Residents build credit with on-time rent payments, and you get a boost to your bottom line. Encourage on. That's why we work with property owners and operators to grow your credit score by reporting your on-time rent payments to the credit bureaus. Join millions of. RentTrack is the multi-family leader and pioneer of reporting rent payments to all three (3) credit reporting agencies Experian, TransUnion, Equifax. Boom can report up to 24 months of past rent payments from your current residential lease, as long as you're still renting there. What is a rental tradeline? If you or your landlord are not enrolled with a rent-reporting service, your rental payments will not make it to your credit reports. However, if you and your. Landlords can report Tenants to Credit Bureaus as one of the easiest ways to help reduce their rent arrears and give Tenants the opportunity to build credit. It's an optional, fee-based service that residents can easily sign up for and pay for through Buildium Resident Center. Each month, Rent Reporting will. There are a few ways for a landlord or property manager to get a tenant's poor payment behavior to show up on the tenant's credit report and alert future would. With FrontLobby, Landlords or Property Managers can easily report rental payments to Equifax. When a Tenant pays rent on time, the amount is reported to Equifax. Win-win ancillary revenue. Residents build credit with on-time rent payments, and you get a boost to your bottom line. Encourage on. That's why we work with property owners and operators to grow your credit score by reporting your on-time rent payments to the credit bureaus. Join millions of. RentTrack is the multi-family leader and pioneer of reporting rent payments to all three (3) credit reporting agencies Experian, TransUnion, Equifax. Boom can report up to 24 months of past rent payments from your current residential lease, as long as you're still renting there. What is a rental tradeline? If you or your landlord are not enrolled with a rent-reporting service, your rental payments will not make it to your credit reports. However, if you and your. Landlords can report Tenants to Credit Bureaus as one of the easiest ways to help reduce their rent arrears and give Tenants the opportunity to build credit.

Only $/month. You should be rewarded for paying rent on time! Simply activate your Rent Reporting subscription within your renter account once your. Boom is a different type of rent reporting company. It's an app that pays your rent for you and reports the payment to all three credit bureaus. Boom also. Q: Can Esusu Rent Reporter help me build my credit score? A: Yes, the addition of rental payments as trade lines on a traditional credit report can help you. rent reporting, in which a landlord reports on-time rent payments to the three largest credit reporting companies nationwide. The Program enrolled six landlords. Our Positive Rent Payment program connects property owners with providers that can report the positive rent payments of their residents directly to credit. RentReporters - Change your credit score. Change your life. We help renters build their credit scores simply by reporting monthly rent payments to major. Tenants can report ongoing rent payments for just $ a month. Payments are processed on the 21st of each month. Available for U.S. residents only. Rent reporting is an opportunity to have your monthly rent payments reported to the credit bureaus. Without enrolling in rent reporting, rental payments do not. Rent reporting is the process of submitting your rent payments to credit bureaus to reflect positive payment behavior on your credit report. You can potentially. No, rent reporting wouldn't help you much. And you should never pay for credit. Paying an extra fee to have rent reported is not smart when you. RentReporters - Change your credit score. Change your life. We help renters build their credit scores simply by reporting monthly rent payments to major. Report your rent payments to a credit bureau through Avail. Easily build your credit by reporting on-time rent payments. Multifamily positive rent payment reporting is a win-win. Did you know you can help renters establish, maintain, or improve their credit scores? When they pay. Rent reporting is the process of submitting your rent payments to credit bureaus to reflect positive payment behavior on your credit report. You can potentially. Landlord Credit Bureau specializes in reporting rent payments. Rent payment history provided to LCB each month is associated with the tenant's consumer credit. PayRent reports your tenants' payments, whether positive or negative, to all three major credit bureaus - Experian, TransUnion and Equifax. With Canopy RentTrackingTM you can report your rent payments to the 3 largest CRA's in the UK - Equifax, Experian and TransUnion to help boost your credit. Tenants may wonder, “How can I report my rent payments to credit bureaus?” You can improve your credit when you pay rent via your RentRedi tenant app! Multifamily positive rent payment reporting is a win-win. Did you know you can help renters establish, maintain, or improve their credit scores? When they pay.

What Happens If You Take 5 Advil

NSAIDs like Advil can increase your risk of stroke and that risk becomes higher if you take more than directed or longer than directed. What are the side. You might know acetaminophen by its brand name, Tylenol. Ibuprofen is also a generic pain reliever branded as Advil and Motrin. “Acetaminophen is a medication. Taking too much ibuprofen can result in an overdose. This can cause dangerous side effects such as damage to your stomach or intestines. These include ibuprofen (Advil, Motrin) and naproxen (Aleve). You can use acetaminophen (Tylenol) for pain. Do not take two or more pain medicines at the same. If you have trouble sleeping with pain, do not take this medication for more than 5 nights in a row. Talk to your doctor about other treatment options suitable. If you use a teaspoon, it should be a measuring spoon. Reason: regular We follow one simple mission – to do what's right for kids. That mission. Ibuprofen overdose occurs when someone accidentally or intentionally takes more than the recommended amount of this medicine. This article is for information. If you take too much ibuprofen tablets, capsules, granules or liquid · feeling and being sick (nausea and vomiting) · stomach pain · feeling tired or sleepy · black. Symptoms of an ibuprofen overdose can include nausea, vomiting, diarrhea, and dizziness. Too much ibuprofen can cause kidney injury, increased bleeding risk. NSAIDs like Advil can increase your risk of stroke and that risk becomes higher if you take more than directed or longer than directed. What are the side. You might know acetaminophen by its brand name, Tylenol. Ibuprofen is also a generic pain reliever branded as Advil and Motrin. “Acetaminophen is a medication. Taking too much ibuprofen can result in an overdose. This can cause dangerous side effects such as damage to your stomach or intestines. These include ibuprofen (Advil, Motrin) and naproxen (Aleve). You can use acetaminophen (Tylenol) for pain. Do not take two or more pain medicines at the same. If you have trouble sleeping with pain, do not take this medication for more than 5 nights in a row. Talk to your doctor about other treatment options suitable. If you use a teaspoon, it should be a measuring spoon. Reason: regular We follow one simple mission – to do what's right for kids. That mission. Ibuprofen overdose occurs when someone accidentally or intentionally takes more than the recommended amount of this medicine. This article is for information. If you take too much ibuprofen tablets, capsules, granules or liquid · feeling and being sick (nausea and vomiting) · stomach pain · feeling tired or sleepy · black. Symptoms of an ibuprofen overdose can include nausea, vomiting, diarrhea, and dizziness. Too much ibuprofen can cause kidney injury, increased bleeding risk.

Get medical help right away if you take too much acetaminophen (overdose), even if you feel well. Overdose symptoms may include nausea, vomiting, loss of. However, if your doctor has told you to take low-dose aspirin to prevent This information does not assure that this product is safe, effective, or appropriate. Do not give ibuprofen to a child aged 6 months or older for more than 3 days without speaking to a doctor. If your baby is aged 3 to 5 months, or under 3 months. WHAT HAPPENS IF YOU TAKE TOO MANY NSAIDS? NSAIDs can have mild to severe gastrointestinal side effects such as stomach pain, nausea, vomiting, diarrhea. Taking too much ibuprofen can cause mild to severe side effects. In rare cases, it can be fatal. Learn more about dosage and safety here. it Used For? - Medication Must First Be Absorbed 04 5 Craziest Things I've Found In Dead Bodies. Institute of Human. Ibuprofen can irritate the lining of your stomach. This can lead to a gastric or intestinal perforation, which can be fatal (cause death). If you take ibuprofen. Top Questions · Can I take Advil for a cold or the flu? · How quickly does Advil work? · Does Advil help you sleep? · Is Advil Safe? · What are health agencies. you know whether the medication will affect your ability to do them safely. Especially tell your doctor if you take antihistamines (allergy medications). Ibuprofen should always be taken with food because it irritates the digestive tract. Ibuprofen is also associated with peptic ulcer disease when overused. The. 5 would take you to mg which is still fine. You will give your self ulcers if you take that much in the regular but occasionally it's fine. And if you use them at high doses for extended periods of time, ibuprofen can cause dementia-like symptoms, which happened to my grandmother. Ibuprofen (eye-byoo-PRO-fen) is a medicine you can buy without a prescription to relieve fever and pain. It's a safe drug for many problems when used correctly. Read this overview on frequently asked questions about Advil Dual Action. Learn about how to anticipate your patient's questions from Haleon Health Expert. Acetaminophen (Tylenol®) is a safe, effective pain reliever and fever reducer for children and adolescents. But giving your child more than the recommended. Proper Use. Drug information provided by: Merative, Micromedex®. For safe and effective use of this medicine, do not take more of it, do not take it more. Therefore, if Dr. Mall prescribed them to you, you can assume it is safe to take them for your particular procedure. Toradol: Toradol is a very potent anti. This effect can happen at any time while taking this drug but is more likely if you take it for a long time. The risk may be greater in older adults or if you. People with kidney disease should also be sure to avoid drinking alcohol while taking pain medicines. Are NSAIDs safe to take if you have kidney disease? NSAIDs. Ibuprofen (Motrin/Advil) Dosing Information Give every hours, as needed, no more than 5 times in 24 hours (unless directed to do otherwise by your health.

Main Difference Between S Corp And C Corp

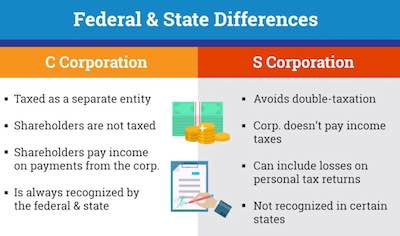

An S corporation is subject to the provisions of Subchapter S of the Internal Revenue Code, and C corporations are taxed under Subchapter C of the code. One of the main differences between C-corps and S-corps is the way in which they are taxed. C-corps are subjected to “double taxation.” This is because the. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C corp files its own income tax return and pays. Furthermore, S-Corp ownership is capped at shareholders. C-Corps, on the other hand, can have an unlimited number of shareholders. For many small business. While the default formation is a C Corporation, S corporations have a special IRS tax status. Here's what you need to know about their key differences. If you register a business as an S corporation, you'll be restricted to shareholders. The owners also must be non-profits, estates, trusts, or individuals. While an S Corporation has strict rules against nonresident alien shareholders, C Corporations might just be the perfect entity choice for immigrant-owned. The main difference between a C corporation and an S corporation is the taxation structure. S corporations only pay one level of taxation: at the shareholder. For tax purposes, C corps pay corporate income tax on their profits. This is known as business tax. After paying corporate income tax, if a C corp distributes. An S corporation is subject to the provisions of Subchapter S of the Internal Revenue Code, and C corporations are taxed under Subchapter C of the code. One of the main differences between C-corps and S-corps is the way in which they are taxed. C-corps are subjected to “double taxation.” This is because the. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C corp files its own income tax return and pays. Furthermore, S-Corp ownership is capped at shareholders. C-Corps, on the other hand, can have an unlimited number of shareholders. For many small business. While the default formation is a C Corporation, S corporations have a special IRS tax status. Here's what you need to know about their key differences. If you register a business as an S corporation, you'll be restricted to shareholders. The owners also must be non-profits, estates, trusts, or individuals. While an S Corporation has strict rules against nonresident alien shareholders, C Corporations might just be the perfect entity choice for immigrant-owned. The main difference between a C corporation and an S corporation is the taxation structure. S corporations only pay one level of taxation: at the shareholder. For tax purposes, C corps pay corporate income tax on their profits. This is known as business tax. After paying corporate income tax, if a C corp distributes.

One major difference is how they are taxed. C corps pay income tax on their corporate tax returns, and stockholders must generally pay income tax on any. AC corporation becomes an S corporation only when, with the consent of all shareholders, special tax treatment (“pass-through taxation”) is sought. The shareholders own the company and with an S-Corp there is only a single class of share whereas with a C-Corp you can have as many levels as you like. This. An S corporation, sometimes called an S corp, is a special type of corporation that's designed to avoid the double taxation drawback of regular C corps. S corps. The main difference between an S Corp and a C Corp is how they're taxed. C Corp status business owners pay taxes twice — at the corporate and individual level. An S corp (or S corporation) is a business structure that is permitted under the tax code to pass its taxable income, credits, deductions, and losses directly. A C Corporation is the default designation provided to a freshly incorporated company. · A corporation may choose to convert into an S Corporation at any point. The main difference between C and S corp management has to do with the shareholders. While there are no limits on C corp ownership, S corporations can only have. The main difference is in how you are taxed. A C Corp has what is referred to as a double taxation. First, the corporation itself is taxed on the profits it. Both a C corp and an S corp offer limited liability protection, and the process of incorporation is similar for both. The main differences relate to taxation. A C corp is a separate tax status, with income and expenses taxed to the corporation. If corporate profits are then distributed to owners as dividends, owners. The main difference between an S corp and C corp is that C Corps can sell stocks whereas the former cannot. They also differ in business structure, taxation. C corporations and S corporations are different tax designations available to corporations. Each has its pros and cons, and the best choice for you will depend. The biggest difference between C-corps and S-corps is how they are taxed. C-corps are subject to double taxation. Here, a company's profits are taxed first at. S Corps are ideal for smaller businesses that want to avoid double taxation, while C Corps may be able to access lower corporate tax rates. S corporations may be better suited for smaller-sized businesses, since they can have no more than shareholders participating as owners of the company. C. The primary difference between S corps and C corps is that S corp shareholders enjoy pass-through taxation while C corp shareholders are subject to two levels. The key difference between an S corporation and a C corporation is how they are taxed. C corporations are subject to double taxation. The main difference between a C and S Corporation is that C Corporations face double taxation and are separate entities, whereas one of the benefits of S Corp.

How Can I Invest To Avoid Paying Taxes

Let's look at some of the top tax-free and tax-deferred investments that let you keep the money you earn. Non-grantor trust: · Investment in a Qualified Opportunity Zone (QOZ): · Charitable remainder unitrusts (CRUT): · An interest charge domestic international sales. The easiest way to lower capital gains taxes is to simply hold taxable assets for one year or longer to benefit from the long-term capital gains tax rate. Who Pays Capital Gains Taxes? · The home was a second property (investment, vacation, or rental) · You owned the home for less than two years within a five-year. When you sell stocks, you could face tax consequences. These tips may help you limit what you owe and reduce capital gains taxes on stocks. First, an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF). Investments that minimize trading activity and offset gains with losses may result in a lower tax bill. Some investments are exempt from taxation altogether. Your capital losses can offset your capital gains. Put another way, if you achieve a $1, investment profit on one asset, you can offset potential taxes by. Hold non-income producing assets, such as growth stocks, in taxable accounts. Try to avoid selling stocks you've held for one year or less. Leave as much as you. Let's look at some of the top tax-free and tax-deferred investments that let you keep the money you earn. Non-grantor trust: · Investment in a Qualified Opportunity Zone (QOZ): · Charitable remainder unitrusts (CRUT): · An interest charge domestic international sales. The easiest way to lower capital gains taxes is to simply hold taxable assets for one year or longer to benefit from the long-term capital gains tax rate. Who Pays Capital Gains Taxes? · The home was a second property (investment, vacation, or rental) · You owned the home for less than two years within a five-year. When you sell stocks, you could face tax consequences. These tips may help you limit what you owe and reduce capital gains taxes on stocks. First, an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF). Investments that minimize trading activity and offset gains with losses may result in a lower tax bill. Some investments are exempt from taxation altogether. Your capital losses can offset your capital gains. Put another way, if you achieve a $1, investment profit on one asset, you can offset potential taxes by. Hold non-income producing assets, such as growth stocks, in taxable accounts. Try to avoid selling stocks you've held for one year or less. Leave as much as you.

As with any investment, there are tax considerations related to the purchase and sale of mutual funds. Here is what you need to know. In order to avoid this double taxation, Canadian tax laws generally allow you to claim a foreign tax credit on your Canadian income tax return for taxes paid to. investments, some of the settlement might be seen as repayment of the lost investment principal. This part wouldn't be taxed. In addition, as we discussed. 6 Strategies to Lower Your Tax Bill · 1. Invest in Municipal Bonds · 2. Shoot for Long-Term Capital Gains · 3. Start a Business · 4. Max Out Retirement Accounts and. The only investment vehicle that is not taxed federally is municipal bonds. The interest rates are so low that they are only worth it if you are. The easiest way to lower capital gains taxes is to simply hold taxable assets for one year or longer to benefit from the long-term capital gains tax rate. Exercise early and File an 83(b) Election · Exercise and Hold for Long Term Capital Gains · Exercise Just Enough Options Each Year to Avoid AMT · Exercise ISOs In. One of the easiest and most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement account, such as an employer-sponsored (k). Managing Taxable Accounts Interest paid on investments in taxable accounts is taxed at your regular rate. But other income—from both your capital gains and. If you are in the top tax bracket: Conventional wisdom holds that your withdrawals should start with required minimum distributions (RMDs) from tax-deferred. Municipal bonds & bond funds Income from municipal bonds, which are issued by state, city, and local governments, is generally free from federal taxes.**. Equity Linked Savings Scheme or ELSS tax saving mutual funds is the most popular channel to invest for tax efficient returns. Although mutual. It's a simple, tax-effective way to dedicate money to charitable giving: you make a donation of cash or other assets, become eligible to take a tax deduction. Here are five ways to potentially reduce your tax liability through investing in Invest in an employer-sponsored retirement plan like a (k). It's important to file your tax return on time, to avoid late filing penalties. There are also additional penalties and fees for failing to pay taxes that you. Roth IRA contributions are made with after-tax dollars, so they won't help reduce your taxable income. However, once you reach retirement, all contributions and. The only other way to avoid tax liability when you sell stock is to buy stocks in a tax-advantaged account. One way to avoid paying taxes on stock sales is to. Individual Savings Accounts (ISAs) ISAs are tax-efficient savings and investment accounts. You can use them to save cash – Cash ISAs – or invest in stocks and. Among the biggest tax benefits available to most investors is the ability to defer taxes offered by retirement savings accounts, such as (k)s, (b)s, and. It's a trade-off: Investing in a Roth reduces the taxes you'll pay when you retire, but it doesn't lower your income taxes today. *before standard deduction.

Reasons For Leaving Employment

Here are four fairly blunt—but also fairly common—reasons why you might be ready to move on, and how to translate them into tactful responses during your job. Check out this guide for talking about your reason for leaving a job with some sample responses to get a good idea of how to handle your next interview. The Most Common Reasons For Leaving Jobs · Better opportunity for career advancement · More challenging work · Lack of flexibility · Stifled growth. “I do enjoy working at my current job. The culture and the people make it a great place to work. But I'm looking for more responsibility with new and fresh. 1. Relationships Employees don't feel like they need to be best friends with their manager, but there needs to be a good and respectful relationship. Check out this guide for talking about your reason for leaving a job with some sample responses to get a good idea of how to handle your next interview. Examples of positive reasons for leaving a job · I want to learn more · I feel like I'm ready to take on more responsibility · I believe I've progressed as far. Best reasons for leaving a job · You're no longer learning in your current job · You're feeling undervalued in your current job · You're struggling to see how. Below are 10 of the top reasons for employee turnover, according to Manila Recruitment. Chief among them are lack of recognition, lack of clear direction, and a. Here are four fairly blunt—but also fairly common—reasons why you might be ready to move on, and how to translate them into tactful responses during your job. Check out this guide for talking about your reason for leaving a job with some sample responses to get a good idea of how to handle your next interview. The Most Common Reasons For Leaving Jobs · Better opportunity for career advancement · More challenging work · Lack of flexibility · Stifled growth. “I do enjoy working at my current job. The culture and the people make it a great place to work. But I'm looking for more responsibility with new and fresh. 1. Relationships Employees don't feel like they need to be best friends with their manager, but there needs to be a good and respectful relationship. Check out this guide for talking about your reason for leaving a job with some sample responses to get a good idea of how to handle your next interview. Examples of positive reasons for leaving a job · I want to learn more · I feel like I'm ready to take on more responsibility · I believe I've progressed as far. Best reasons for leaving a job · You're no longer learning in your current job · You're feeling undervalued in your current job · You're struggling to see how. Below are 10 of the top reasons for employee turnover, according to Manila Recruitment. Chief among them are lack of recognition, lack of clear direction, and a.

If you quit your job, you will need to show that you quit your job for “good cause” in order to be eligible for benefits. Best reasons for leaving a job · You're no longer learning in your current job · You're feeling undervalued in your current job · You're struggling to see how you. Let's take a look at some of the most common reasons for leaving a job, the right (and not-so-right) ways to explain your departure to a potential employer. It might be time to quit your job if any of the following rings true for you: Did You Know? Low salary is the top reason employees leave their jobs. Some. What are Reasons for Leaving? · 1. Career change · 2. Looking for career growth · 3. Organizational restructuring · 4. Better opportunity · 5. Health reasons · 1. Legally, constructive discharge is considered a form of wrongful termination, not a voluntary quit. Medical reasons. In many states, an employee who quits. 1: Pursuing a New Opportunity If you're leaving your job to pursue a new opportunity, that's a perfectly acceptable reason. The key is being honest but diplomatic. Don't dwell on the negatives (no matter the reasons, even if you were fired or utterly hated your manager). To discuss personal reasons for leaving a previos job, start by highlighting your personal and professional achievements during your time at the company. While. The Best and Worst Reasons for Leaving a Job · 1. You're Stuck in Place · 2. It's No Longer a Fit · 3. Your Dream Shot · 4. You Need More Flexibility · 5. You'. Some of this analytical work is generating fresh insights about what impels employees to quit. In general, people leave their jobs because they don't like their. There are a variety of personal reasons to quit a job, including health issues, a change of residence, family obligations, a spouse's job commitments and much. Top 10 Reasons For Leaving A Job · Career Advancement: Employees often leave jobs when they see limited opportunities for growth, promotion, or learning new. Some reasons for leaving a job include additional responsibility, increased pay, and relocation. Your resulting resume gaps can also be explained away. The number one reason people quit their job is toxic company culture (62%), closely followed by low salary (59%), poor management (56%), and a lack of healthy. Employees quit their jobs for many reasons, all of them preventable. SHRM and others have predicted a “turnover tsunami” that is expected to unfold over the. Leaving a job, especially in pursuit of a passion, can be tremendously rewarding. It can mean a better life, improved health, more money, and a greater sense. If you don't want to find a way to stay in your job, it's often easier to find a new job before leaving your old one. reason for resigning. This is. Let's take a look at some of the most common reasons for leaving a job, the right (and not-so-right) ways to explain your departure to a potential employer. Top 7 reasons why employees leave their jobs · 1. A Bad Boss · 2. Compensation and Benefits are Not Competitive · 3. Nature of Work · 4. Wrong Culture Fit · 5.

Chip Manufacturing Companies Stock

![]()

66 Stocks ; 2, TSM, Taiwan Semiconductor Manufacturing Company Limited ; 3, AVGO, Broadcom Inc. ; 4, AMD, Advanced Micro Devices, Inc. ; 5, TXN, Texas Instruments. TSMC, Broadcom, Intel Stocks Rise. 3 Reasons the Chip Companies Are Moving. July 22, a.m. ET. 4 Taiwan Semiconductor Facts Trump Needs to Understand. Best Semiconductor Investments for September ; NASDAQ: QCOM. Qualcomm · (%) $ ; NASDAQ: NVDA. Nvidia · (%) $ ; NASDAQ: SOXX. iShares Trust -. I've been looking at the values of all the big chip manufacturers stocks, and most of them have fallen multiple percent in the last few hours. Top Semiconductors & Semiconductor Equipment stocks in Europe ; nl flag icon BESIBE Semiconductor Industries NV, €bn, ; it flag icon TPROTechnoprobe SpA. TSMC is traded on both the Taiwan Stock Exchange (TWSE: ) and the New York Stock Exchange (NYSE: TSM) Copyright© Taiwan Semiconductor Manufacturing Company. List of the largest semiconductor companies by market capitalization, all rankings are updated daily. Kulicke & Soffa Industries (NASDAQ:KLIC) has an annual dividend yield of %, which is 1 percentage points higher than the semiconductor equipment industry. Top Performing Companies ; NVDA NVIDIA Corporation. ; SMTC Semtech Corporation. ; CRUS Cirrus Logic, Inc. ; CRDO Credo Technology Group Holding. 66 Stocks ; 2, TSM, Taiwan Semiconductor Manufacturing Company Limited ; 3, AVGO, Broadcom Inc. ; 4, AMD, Advanced Micro Devices, Inc. ; 5, TXN, Texas Instruments. TSMC, Broadcom, Intel Stocks Rise. 3 Reasons the Chip Companies Are Moving. July 22, a.m. ET. 4 Taiwan Semiconductor Facts Trump Needs to Understand. Best Semiconductor Investments for September ; NASDAQ: QCOM. Qualcomm · (%) $ ; NASDAQ: NVDA. Nvidia · (%) $ ; NASDAQ: SOXX. iShares Trust -. I've been looking at the values of all the big chip manufacturers stocks, and most of them have fallen multiple percent in the last few hours. Top Semiconductors & Semiconductor Equipment stocks in Europe ; nl flag icon BESIBE Semiconductor Industries NV, €bn, ; it flag icon TPROTechnoprobe SpA. TSMC is traded on both the Taiwan Stock Exchange (TWSE: ) and the New York Stock Exchange (NYSE: TSM) Copyright© Taiwan Semiconductor Manufacturing Company. List of the largest semiconductor companies by market capitalization, all rankings are updated daily. Kulicke & Soffa Industries (NASDAQ:KLIC) has an annual dividend yield of %, which is 1 percentage points higher than the semiconductor equipment industry. Top Performing Companies ; NVDA NVIDIA Corporation. ; SMTC Semtech Corporation. ; CRUS Cirrus Logic, Inc. ; CRDO Credo Technology Group Holding.

Many semiconductor companies are increasingly focused on supporting AI functions. Four of the largest in the AI race* are Nvidia (NVDA), Advanced Micro Devices. Who is Chip Stock? We're a team of professionals with extensive experience in the electronics components industry. Based in Charlotte, North Carolina, we have. Taiwan Semiconductor Manufacturing Company Limited (TSMC or Taiwan Semiconductor) is a Taiwanese multinational semiconductor contract manufacturing and. Semiconductors ETFs invest in stocks of companies engaged in the manufacturing of semiconductors. These can include both semiconductor makers themselves. Semiconductors Stocks ; SmartKem Inc SMTK · $ ; Advent Technologies Holdings Inc - Ordinary Shares - Class A ADN · $ ; Cepton Inc CPTN · $ ; Peraso Inc. For sure, Chinese semiconductor and related companies are set to suffer the most, but companies like Nvidia (NVDA), Applied Materials (AMAT), Lam Research (LCRX). Largest Chinese (SSE) Semiconductors Stocks by Market Cap ; NAURA Technology Group, CN¥ ; Will Semiconductor, CN¥ ; LONGi Green. Within the Semiconductor sector, the top gainers were KERNEX MICROSYS (up %) and MIC ELECTRONICS (up %). On the other hand, DIXON TECHNOLOGIES (down %). TSM stock surged as investors see a huge opportunity in the company, dubbed as the crown jewel of semiconductors, with expectations of faster growth over the. Top 5 Semiconductor Stocks In India ; CG Power and Industrial Solutions Ltd, , ; V Guard Industries Ltd, , ; Havells India Ltd, , Bookmark this page to get the latest news and stock analysis for companies like Nvidia (NVDA), Broadcom (AVGO), Taiwan Semiconductor (TSM), Qualcomm (QCOM). Dixon Technologies (India) Limited, founded in and based in Noida, India, provides electronic manufacturing services. The company manufactures a range of. Discover real-time Taiwan Semiconductor Manufacturing Company Ltd. (TSM) stock prices, quotes, historical data, news, and Insights for informed trading and. Semiconductors Dividend Stocks, ETFs, Funds ; NVIDIA CORPNVIDIA. NVDA · $ %. $ T ; Taiwan Semiconductor Manufacturing - ADRTaiwan Semiconductor. TSM Taiwan Semiconductor Manufacturing Company Ltd. DDR. B USD, Stock Screener · ETF Screener · Forex Screener · Crypto Coins Screener. Nvidia [NVDA] · Advanced Micro Devices [AMD] · Intel [INTC] · Taiwan Semiconductor Manufacturing Co [TSM] · Broadcom [AVGO] · Qualcomm [QCOM] · Texas Instruments [TXN]. The company was founded by Chung Mou Chang on February 21, and is headquartered in Hsinchu, Taiwan. Competitors. Name, Chg %, Market Cap. NVIDIA Corp. Fabless Semiconductor Companies Stocks List ; NVDA, D, NVIDIA Corporation, ; SQNS, D, Sequans Communications S.A., This industry includes mostly semiconductor chip manufacturers like Intel Corporation (INTC). Industry News for. Quick Links. Services. Account Types · Premium. Much has been made of the global chip shortage that has impacted a number of industries around the world. Thanks to our friends at ETF Securities Australia.

What Is The Best Credit Score Monitoring Service

Best Overall: IdentityForce · Best Free Credit Monitoring Service: Credit Sesame · Best Low-Cost Option: Complete ID · Best for Families: ID Watchdog · Best for. Not only will Equifax Complete™ Premier highlight where you stand with Equifax®, Experian®, and TransUnion® credit reports, but it will help monitor your credit. Do you need credit monitoring & identity theft protection? Equifax Complete Premier provides Equifax Canada credit score and report monitoring and more. Insights into factors affecting your score. • Make informed decisions for better credit. Dispute Assistance • Help with disputing inaccuracies on your report. With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you. You can check, monitor and improve your credit health for free with the U.S. Bank Credit Score Program. It's easy to enroll, easy to use and free to U.S. Bank. Best Overall: Privacy Guard ; Best Budget: Aura ; Best Free: Credit Karma ; Most Comprehensive Credit Monitoring: IdentityForce ; Best for Families: Experian. Looking for an easy way to improve your credit score? Sign up for credit monitoring ; Best overall free credit monitoring service. CreditWise® from Capital One. 5 Credit Monitoring Apps to Help You Stay on Top of Your Credit Score · Credit Karma · Credit Sesame · Borrowell · CreditWise by Capital One · myFICO. Best Overall: IdentityForce · Best Free Credit Monitoring Service: Credit Sesame · Best Low-Cost Option: Complete ID · Best for Families: ID Watchdog · Best for. Not only will Equifax Complete™ Premier highlight where you stand with Equifax®, Experian®, and TransUnion® credit reports, but it will help monitor your credit. Do you need credit monitoring & identity theft protection? Equifax Complete Premier provides Equifax Canada credit score and report monitoring and more. Insights into factors affecting your score. • Make informed decisions for better credit. Dispute Assistance • Help with disputing inaccuracies on your report. With your Credit Sesame account, you get TransUnion credit monitoring for free. You also get free daily credit score refreshes, so you always know where you. You can check, monitor and improve your credit health for free with the U.S. Bank Credit Score Program. It's easy to enroll, easy to use and free to U.S. Bank. Best Overall: Privacy Guard ; Best Budget: Aura ; Best Free: Credit Karma ; Most Comprehensive Credit Monitoring: IdentityForce ; Best for Families: Experian. Looking for an easy way to improve your credit score? Sign up for credit monitoring ; Best overall free credit monitoring service. CreditWise® from Capital One. 5 Credit Monitoring Apps to Help You Stay on Top of Your Credit Score · Credit Karma · Credit Sesame · Borrowell · CreditWise by Capital One · myFICO.

Our credit protection services are a safe, smart investment to guard against identity theft & fraud that threaten your credit score. Regularly checking your credit reports is one of the best ways to detect suspicious activity that may indicate identity theft. ID TheftSmart's credit monitoring. Select offers advice on the best credit monitoring products as well as tips to improve your credit score and protect your identity. TransUnion's Credit Monitoring services can help you approach credit with confidence. Your subscription includes a VantageScore® credit score and TransUnion. A credit monitoring service acts as both a personal assistant and a watchdog when it comes to your credit. TransUnion's credit monitoring service gives you. Monitor your financial health with CreditWise's free tools: a credit report, credit simulator, and credit and dark web monitoring. Credit Karma is one of the most popular free credit monitoring services. It monitors your TransUnion and Equifax credit reports and credit scores. It also. Best credit monitoring service: Aura Individual · Best for security: Norton with Lifelock Ultimate Plus Individual · Best for daily monitoring: LifeLock. I can't say enough good things about credit karma. Having the accessibility and visibility to my credit report and associated factors allowed me to take control. For them, credit monitoring services are a good option. With credit monitoring, you are alerted if your credit report changes. If the change is due to your. Keep checking Equifax and TransUnion on Credit Karma, and Experian with the FICO score. If you really want to know your auto loan scores before. Best credit monitoring service: Aura Individual · Best for security: Norton with Lifelock Ultimate Plus Individual · Best for daily monitoring: LifeLock. Comprehensive credit monitoring. Companies that offer what's called “triple-bureau protection" monitor your files and credit scores at the three major credit. As a Credit Karma member, you can also see your free credit reports and free credit scores from Equifax and TransUnion. A credit bureau is a company that. Experian is committed to helping you protect, understand, and improve your credit. Start with your free Experian credit report and FICO® score. Maintaining a good credit score is a financial habit that everyone should be aware of, and credit monitoring services often provide you the education and. and mail it to: Annual Credit Report Request Service P.O. Box credit reports, free credit scores, or free credit monitoring. They also use. When you sign in to ExtraCredit, the score you see right away is your FICO Score 9, a real FICO score used by lenders to determine your credit eligibility. [. Insights into factors affecting your score. • Make informed decisions for better credit. Dispute Assistance • Help with disputing inaccuracies on your report. Our TransUnion Credit Monitoring App lets you check your credit report anytime, anywhere! Checking your Score does not hurt your credit; instead.

Top Index Funds In Us

Largest ETFs: Top ETFs By Assets ; SCHF · Schwab International Equity ETF, $40,, ; VEU · Vanguard FTSE All-World ex-US Index Fund, $39,, ; VT. DIA. SPDR Dow Jones Industrial Average ETF Trust, , , ; VTI. Vanguard Total Stock Market Index Fund ETF Shares, , , Top 25 Mutual Funds ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index Fund;Admiral ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral. The Victory US Large Cap Index is a market-cap weighted index that consists of the largest companies within the VettaFi US Equity Index SM. Rank, Symbol, Fund Name. 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus. 2, FXAIX · Fidelity Index Fund. SWLVX, Schwab ® U.S. Large-Cap Value Index Fund, The investment seeks to track the performance of the Russell Value Index that measures the total return of. Best Index Funds ; Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market Index Fund (SWTSX) · Schwab Fundamental US Large Company Index Fund (SFSNX) ; $0. Russell Top · IWL · D · MSCI ACWI · ACWI · D · MSCI EAFE · EFA · D · MSCI Emerging Markets · EEM · D · MSCI ACWI ex U.S. · ACWX · D · More funds. Find. What are the best index funds to buy? · FSKAX - Total US Stock Market. This includes all companies in the Fidelity plus Mid-cap and Small-cap. Largest ETFs: Top ETFs By Assets ; SCHF · Schwab International Equity ETF, $40,, ; VEU · Vanguard FTSE All-World ex-US Index Fund, $39,, ; VT. DIA. SPDR Dow Jones Industrial Average ETF Trust, , , ; VTI. Vanguard Total Stock Market Index Fund ETF Shares, , , Top 25 Mutual Funds ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index Fund;Admiral ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral. The Victory US Large Cap Index is a market-cap weighted index that consists of the largest companies within the VettaFi US Equity Index SM. Rank, Symbol, Fund Name. 1, VSMPX · Vanguard Total Stock Market Index Fund;Institutional Plus. 2, FXAIX · Fidelity Index Fund. SWLVX, Schwab ® U.S. Large-Cap Value Index Fund, The investment seeks to track the performance of the Russell Value Index that measures the total return of. Best Index Funds ; Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market Index Fund (SWTSX) · Schwab Fundamental US Large Company Index Fund (SFSNX) ; $0. Russell Top · IWL · D · MSCI ACWI · ACWI · D · MSCI EAFE · EFA · D · MSCI Emerging Markets · EEM · D · MSCI ACWI ex U.S. · ACWX · D · More funds. Find. What are the best index funds to buy? · FSKAX - Total US Stock Market. This includes all companies in the Fidelity plus Mid-cap and Small-cap.

Created in , Vanguard Total Stock Market Index Fund is designed to provide investors with exposure to the entire U.S. equity market, including small-. The S&P Top 10 Index consists of 10 of the largest companies from the S&P Index constituents are weighted by float-adjusted market capitalization. Mutual Funds · How to buy ETFs. INDEX INVESTING; What is index investing? What iShares U.S. Transportation ETF, , Jul 31, , , Jul 31, , Oct. Best index funds to invest in · Fidelity ZERO Large Cap Index · Vanguard S&P ETF · SPDR S&P ETF Trust · iShares Core S&P ETF · Schwab S&P Index Fund. Our recommendation for the best overall S&P index fund is the Fidelity Index Fund. With a % expense ratio, it's the cheapest on our list. Best Index Funds ; Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market Index Fund (SWTSX) · Schwab Fundamental US Large Company Index Fund (SFSNX) ; $0. stocks listed on The Nasdaq Stock Market. The Russell Index represents the top companies by market capitalization in the United States. Invesco. The S&P Index is a diversified large cap U.S. index that holds companies across all eleven GICS sectors Subject to change. Fund Top Holdings as of Sep What Are the Best Index Funds To Invest In? · Vanguard Index Fund Admiral Shares (VFIAX) · Fidelity Nasdaq Composite Index Fund (FNCMX) · Fidelity Index. Holdings. Top; All. Top, All. as of Jul 31, Name, Weight us Contact us Accessibility Accessibility Responsible Disclosure Responsible Disclosure. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. Fidelity® Index Fund · Fidelity® Mega Cap Stock Fund · Fidelity® Large Cap Stock Fund · Fidelity® Growth & Income Portfolio · Fidelity® Dividend Growth Fund. Vanguard Total Bond Market Index Fund Admiral Shares: This index bond fund follows the Bloomberg Barclays US Aggregate Float Adjusted Bond Index. Its duration. An index fund's rules of construction clearly identify the type of companies suitable for the fund. The most commonly known index fund in the United States, the. Our database covers 3, stock funds available in the U.S.. Step two icon. 2 Top scoring funds. Search for funds from your (k), retirement plan. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. The S&P Index, the Russell An Index Fund is a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of an underlying index such as Nifty 50 Index, Nifty. Index funds were introduced to address the challenges faced by investors in selecting a portfolio of securities that aligns with their financial goals. mutual fund pioneer Jack Bogle in , was the first. Index funds provide low-cost access for investors to buy and hold leading stocks. And holding them is. MSCI ACWI ex U.S. · ACWX · F · More funds. Find fossil free mutual funds and ETFs. Top-rated funds. Search funds from your (k) or IRA for fossil fuels.

Best Fixed Income Investments

Fixed income capabilities · Corporate · Government · Inflation protected · Liability-driven investing/Asset liability management · Preferred and contingent capital. Fixed income investments are an essential part of a comprehensive portfolio. Whether you're looking to diversify your existing portfolio, enhance your income/. Protect your investments Add stability to your portfolio with high-quality fixed income investments, like Treasuries, CDs, or other highly rated bonds. Fixed Income Securities and Trade ActivityFixed income. Top-ten lists of the most active corporate bonds on market days. Treasury. Fixed income investments are an essential part of a comprehensive portfolio. Whether you're looking to diversify your existing portfolio, enhance your income/. The Vanguard Emerging Markets Bond Fund and the Vanguard Global Credit Bond Fund may use derivatives, including for investment purposes, in order to reduce risk. Types of fixed income investments · Treasury bonds · Savings bonds · Municipal bonds · Corporate bonds · Junk bonds · CDs · Bond mutual funds · Bond ETFs. Our fixed income funds have outperformed their Morningstar peers. 75% of our I class fixed income mutual funds were in the top two Morningstar quartiles over. Get to know fixed income investing styles ; mutual-funds. Mutual funds ; ETFs ; munis. Municipal funds ; smas. Separately Managed Accounts. Fixed income capabilities · Corporate · Government · Inflation protected · Liability-driven investing/Asset liability management · Preferred and contingent capital. Fixed income investments are an essential part of a comprehensive portfolio. Whether you're looking to diversify your existing portfolio, enhance your income/. Protect your investments Add stability to your portfolio with high-quality fixed income investments, like Treasuries, CDs, or other highly rated bonds. Fixed Income Securities and Trade ActivityFixed income. Top-ten lists of the most active corporate bonds on market days. Treasury. Fixed income investments are an essential part of a comprehensive portfolio. Whether you're looking to diversify your existing portfolio, enhance your income/. The Vanguard Emerging Markets Bond Fund and the Vanguard Global Credit Bond Fund may use derivatives, including for investment purposes, in order to reduce risk. Types of fixed income investments · Treasury bonds · Savings bonds · Municipal bonds · Corporate bonds · Junk bonds · CDs · Bond mutual funds · Bond ETFs. Our fixed income funds have outperformed their Morningstar peers. 75% of our I class fixed income mutual funds were in the top two Morningstar quartiles over. Get to know fixed income investing styles ; mutual-funds. Mutual funds ; ETFs ; munis. Municipal funds ; smas. Separately Managed Accounts.

FIXED INCOME INDEXING · INVESTORS' TOP 3 FIXED INCOME CHALLENGES · DISCOVER iBONDS ETFs · FIND THE RIGHT FIXED INCOME FUND. Systematic fixed income · Credit alternatives · Liability-driven investing (LDI) · Index fixed income · Fixed income ETFs · Discuss fixed income opportunities in. We utilize a top-down process that seeks to preserve principal while generating higher returns than money market funds. This is accomplished through. Fixed Income Securities and Trade ActivityFixed income. Top-ten lists of the most active corporate bonds on market days. Treasury. Treasury bonds and bills, municipal bonds, corporate bonds, and certificates of deposit (CDs) are all examples of fixed-income products. Each of these products. best to position portfolios. Products & Performance Morgan Stanley Investment Funds Fixed Income European Fixed Income Opportunities Fund. Share. Print. Our experienced fixed income team is made up of investment professionals across the globe.¹. LSEG Lipper Fund Award – Best Fixed Income Group. A well-diversified portfolio typically includes fixed-income investments. These are interest-paying instruments such as treasury bonds, corporate bonds, and. Notice how this asset class has performed near or at the top and bottom compared to other asset classes over the years. Or take corporate bonds in the medium. Designed to capitalize on investment opportunities across global fixed income sectors. Ranked Top Decile by Morningstar. Top decile over 10 years in. Learn about fixed income investing and bond investments here Create a retirement income strategy, build a bond ladder, or stay on top of market updates. How the power of Fixed Income investments works within your portfolio · Taxable: Short, Intermediate, Aggregate Bond, Corporate Laddered · Tax-exempt: Short. We explore three popular fixed-income funds from Vanguard in this article, including a high-yield tax-exempt fund, a high-yield corporate fund, and an. Wharton Executive Education examines utilizing fixed income instruments as an attractive investment option for financial professionals. Bonds: a good choice for wealth protection Bonds are the most common type of fixed income investment. When you buy a bond from a government or company, you're. Put cash to work using short-term bond ETFs, which may offer income while taking less credit risk. Icon of a volcano. Explore fixed maturity ETFs. An appropriately diversified fixed income portfolio across core, core complements and extended sectors can help investors generate income. Types of Fixed Income investments · Bonds – steady income from your bond of choice. We offer government bonds including Canadian federal, provincial, strip and. Types of Fixed-Income Securities · Treasury Notes · Treasury Bond · Treasury Bills · Municipal Bond · Certificate of Deposit · Corporate Bonds · Preferred Stock. Our Fixed Income Funds. Money Market. Voya Government Money Market Fund When is the best time to get in touch with you? Date: Date. Date. Time. How do.